A report by online invoices.com reveals that 54% of SME businesses can expect late payment of their invoices beyond the agreed upon credit period. An analysis of late payment of invoices shows 6 days late payment is the norm.

Every business globally experiences overdue invoices, and India is no exception. Unpaid invoices and debt recovery represent a significant challenge to businesses in India and cause several cash flow problems. This causes various attendant issues, such as strained business relationships, and result in financial instability. Most businesses have various financial commitments, such as paying vendors, meeting operating expenses, and investing in the business for future growth. Given below is a table that showcases the delay after the submission of invoices, beyond the agreed upon credit period.

Period of late payment | % of invoices paid late |

2 weeks | 20% |

More than one month | 33% |

More than two months | 20% |

More than 60 days | 27% |

Source: onlineinvoices.com

In the case of manual invoices, 94% of the invoices are paid from 30 to 60 days.

Taurus Collection India has an established track record of conducting ethical collections of unpaid receivables in different geographies. We offer different services like follow-up and collection of unpaid receivables through our trained recovery agents. We also offer comprehensive legal solutions and arbitration services to help you successfully navigate the maze of collecting unpaid invoices and receivables management to enhance your process efficiencies.

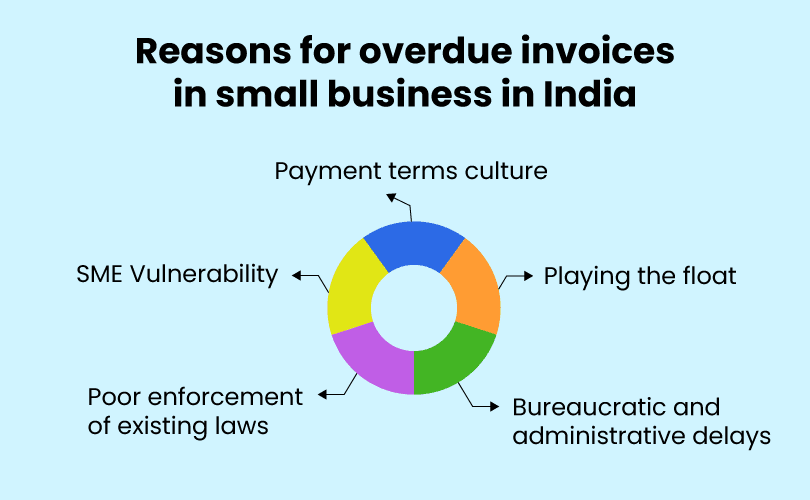

The common causes for late invoice payments in India include:

Indian businesses often offer extended payment terms to businesses in order to secure the business. This existing culture of extended credit periods means you regularly face overdue invoices from clients while conducting your business.

The majority of businesses in India are SME businesses, which means they lack bargaining power while dealing with big businesses who may be their clients. This vulnerability increases as they are dependent on these businesses for their cashflows and are susceptible to late payments.

The MSMED (Micro, small, and medium enterprises Development) Act mandates that SME outstandings must be paid within 45 days. But there is poor legal enforcement. Getting legal recourse is very slow and cumbersome without a guarantee of success.

Many businesses delay payments in order to manage their cash flow issues. This creates problems for their vendors, who are SMEs who are not financially very stable.

Some of the chief causes of overdue invoices include improper invoice management like missing invoices, delayed despatch of invoices, missing documents, unclear terms, and disputed invoices regarding the quality of goods delivered or services rendered.

The impact of overdue invoices on cash flow includes impairment of the daily functioning of the business and prevents the business from growing.

An SME that has loans on its books and also faces payment delays from customers runs the risk of facing increased interest costs.

One of the important consequences of cash flow problems is strained business relations with vendors and suppliers. In severe cases, this can lead to a loss of trust and a break in business relationships.

Reduced liquidity in the market: An increase in unpaid invoices leads to loss of liquidity and reduced market turnover.

This includes the MSMED Act mentioned above, the Insolvency and Bankruptcy Code of 2016, digital solutions like invoice discounting and factoring, and negotiation and arbitration.

Some strategies to prevent overdue invoices include the following: This section also includes tips on how to improve collections on overdue invoices:

1. Set clear payment terms: Your invoice must contain clear payment terms such as net 30, due on receipt, etc. This will state unambiguously the payment terms upfront and avoid invoice disputes.

2. Unambiguous terms: When establishing the relationship with your customer, emphasise your payment terms clearly. This makes the relationship transparent. 55% of most disputes result from loose terms or contractual ambiguity.

3. Use of automated systems: Use an automated invoicing system like Quickbooks, Freshbooks, and Zoho Invoice or any other accounting system. This can help you to automate invoice generation, tracking and reminders. This also avoids the potential for missed invoices and manual errors in invoice generation.

4. Prompt invoicing: This is very essential that as soon as an order is received and goods dispatched, the invoice is sent promptly. Delays result in overlooked invoices.

It is preferable to do invoicing in real time instead of batch invoicing. Batch invoicing results in unwarranted delays.

5. Regular Follow-up: Start following up early and regularly. Whether through a periodic email or some other system, start following up regularly. You can streamline the follow up system through email and regular phone calls. Phone calls can also help you resolve any unresolved issues with customers and make for a better business relationship. The importance of timely payment reminders for businesses cannot be understated. With Taurus Collection B2B app you can keep a track of all debtor payment accounts status on a single screen, anytime, anywhere.

6. Offer the option of different payment methods: Offering different options like credit card, bank or money transfer apps, online money transfer, etc. all help in the quicker collection of your outstanding invoices. Offering small discounts for early payments greatly helps in speedy collections.

7. Implement late payment or interest charges: Penalties for overdue payments: Mention clearly to all your customers that invoices paid late will incur a late fee or a penalty. This will encourage your customers to make timely payments. To maintain good relations, also offer simultaneously grace periods to give them time to assemble their funds and make timely payments.

8. Stay organized: Track invoices by due dates to send your reminders and develop a regular follow up system. At the same time, keep a record of all communications with your client to avoid any ambiguity later on. This will provide you a reference point for discussions.

9. Establish credit policies for clients: While doing this, ensure that you thoroughly vet new clients, especially their payment history with vendors Thorough due diligence into the client’s financial standing is necessary when offering payment terms to new customers. You can use industry credit reports and financial reports to do this form of client vetting. This also avoids future problems with customers who don’t pay on time.

10. Advance Payments: In case of clients who are facing difficulty in making payments, ask for deposits or partial payment of dues to reduce the outstanding balance. Industry practice also includes asking for 50% advance payments.

11. Specify all terms and conditions: The client contract must clearly specify the various terms and conditions. You must clearly enunciate conditions such as late fees, penalties, and consequences of nonpayment of dues. Also clearly state the process for collection of unpaid invoices, arbitration, and legal process, etc. upfront. This will avoid misunderstandings and strained business relations.

12. Leveraging legal solutions: When you enforce statutory compliance through legal solutions, this results in rapid payments by clients. According to the RBI, the interest rate for delayed payments to MSME-registered vendors is three times the bank interest rate. This provision can act as a powerful inducement for suppliers to make timely payments. Use the penalties prescribed in the MSME Act to enforce the payments by clients.

13. Clearance of outstanding dues: Use measures like asking clients to pay all outstanding dues when they need your goods or services urgently. This will force them to clear all outstanding dues and clear their books. Use their urgent requirement to make them pay.

14. Online Solutions: Use online solutions like social media to post about particularly intransigent customers who refuse to pay despite any pressures exerted by you.

15. Use professional collection agencies: Use professional help from ethical collection agencies like Taurus Collection to speedily collect your overdue invoices while maintaining strong relationships with your client with legal protection as well. You can easily outsource your invoice collection function and save costs on frequent calling, follow-up, and pursuing legal solutions by using Taurus Collection services.

Realising overdue payments is like negotiating a quagmire where measures like data-driven client selection, transparent payment terms, implementing safeguards like legal solutions, and strategic thinking all play an important part in your strategic business management. This will facilitate responsible overdue invoice management and bring about financial stability. This way you can maintain robust client relationships and keep your vendors and suppliers happy. Boost your business operations today.

Don’t suffer late payments by clients needlessly. Contact Taurus Collection to help in the collection of your overdue invoices today, ethically & legally. We are standing by to receive your call.

Taurus Collection is a B2B & B2C collection agency that goes beyond the ordinary. With a commitment to excellence, we offer a ‘No Collection, No Fee’ service that is backed by our in-house advocates with an exceptionally high success rate.

Copyright © 2025 All Rights Reserved | Taurus Collection Pvt Ltd. CIN U74999MH2021PTC355667