What is a Debt Collection Agency and What Do They Do?

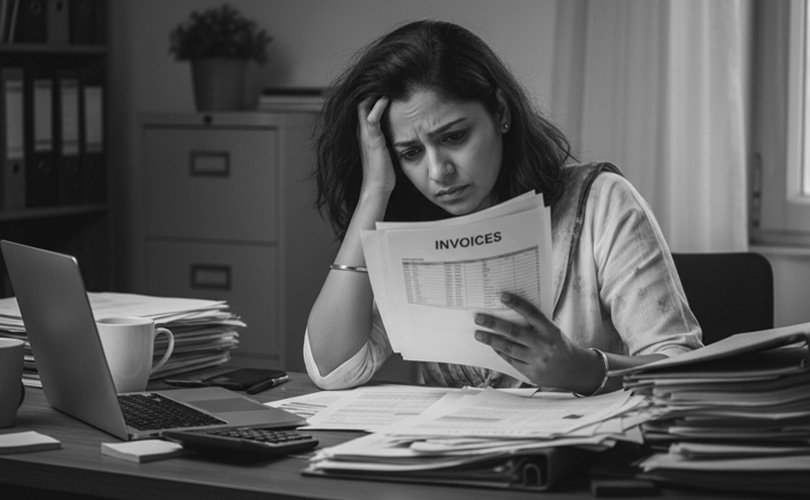

Delayed payments can hinder your business cashflow. Recovery of invoices or debts can be much more difficult if insufficient knowledge or inadequate tools are used to collect invoices.

A debt collection agency in India consists of a team of experienced and knowledgeable agents who specialize in debt collection services. In a country like India, there is an immense growth of professional debt collection agencies that is growing at a faster rate than other industries.

Many enterprises and companies have realized the importance of collection agents and the value of hiring them. This is because they have the ability to collect the amount lent to individuals, businesses, and manufacturing industries. The task at hand is to maintain the right working pattern between clients and the business owner. Debt collection by the business owner can be time consuming and stressful, whereas hiring a debt collection agency can ease the stress of collecting debt from clients.

However, it is important to choose a debt collection agency that is genuine and trustworthy with the promise of increasing collection efficiency. To hire a recovery agency, you need to check their success rate. To be a renowned and successful collection agency, they should add operational efficiency to their daily practice which is done with proper techniques and processes.

What does a debt collection agency do?

The debt collection agency works on behalf of the actual creditors or any company that has lent money or goods to the borrower in order to manage their businesses. They are being paid for the collection of debts from the borrower in a way of commission. For a business to earn profit, one can hire a debt collection agency to maintain cash flow. To recover the collection from the borrower, the company assigns complete data to the agency with proper registered phone numbers to collect the money.

Why should you hire a debt collection agency?

Debt collection agency have experience of collecting unpaid debts from borrowers. Compared to business owners, collecting debt is much more complex and rigid since they cannot focus on the recovery of debts fully. However, hiring a collection agency can reduce your burden of collecting invoices from the borrower. Here are some reasons why you should hire a debt collection agency:

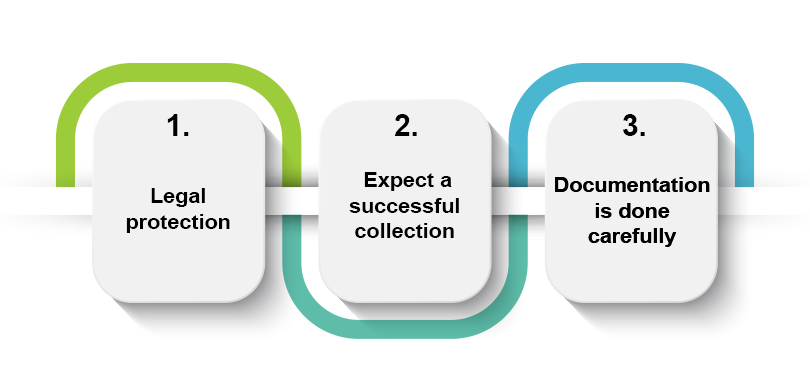

- Legal protection

There are numerous laws that are interlinked with the process of collecting invoices from the borrower. Some borrowers are familiar with the laws and will not hesitate to file a suit against you. However, debt collection agencies know best, since they are well aware of these laws. Hiring a collection agency eliminates the risk of legal action against the collection procedure. - Expect a successful collection

Collection agencies are experts at collecting unpaid debts from your borrowers. They are committed to providing their clients with a high success rate in their collection efforts. While your primary focus is running the business, the collection agency focuses on collecting unpaid invoices. Each trained professional knows the appropriate technique to get the borrower to pay the debt and handle it smoothly. - Documentation is done carefully

Engaging a collection agent ensures proper documentation of the collection process. Every detail of the process done by them is mentioned in their system for many purposes. This will help to prove during the legal process that extensive efforts have been made to collect.

How can a debt collection agency help you?

Debt collection agencies are paid for the collection of debts from borrowers. Hence, they are very efficient in taking steps to control them from making more fuss about the payment.

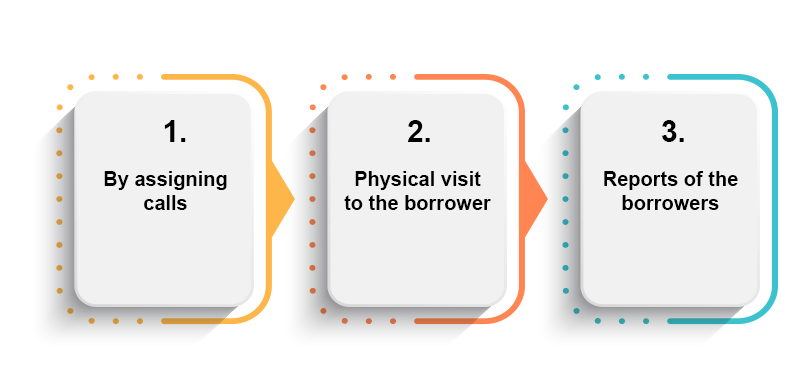

By assigning calls

The company assigns data to collection agents, who are tele-callers by profession. After that, the recovery agent calls the registered number of the borrower. Calls are generally made for the purpose of collecting money.

Physical visit to the borrower

In cases where the absconding borrowers do not answer or ignore the calls for collection, the agents visit the absconded borrowers personally to collect the amount owed.

Reports of the borrowers

A report is necessary for each borrower so that the assigned company can be made aware of the details made.

How can you find a good debt collection agency?

More and more companies are finding that giving credit to borrowers expands the customer pool, however, with these terms only, there is an increase in debt defaulters.

Whenever a debt collection agency comes into the picture, it helps the company recover debts from borrowers. The presence of a good recovery agency is a sign that the company is collecting its debts well.

Let’s take a look at the tips on how to find the best debt collection agency in India.

Do thorough research

As a first step in recovery, it is crucial to identify your requirements, such as from where the collection should be done, is the agency licensed in those states, and does the collection fit with your portfolio.

Verify the success of every agency

It is rightly said that to get good results, one must have a good background. To get good results regarding a collection, it would be best for a company to review an agency that has been catering for more than 5 years.

Advance technology

If you want to choose the best collection agency for recovery, the agency must be equipped with the best technology in the industry. When incorporating with any agency, it is necessary to verify that they use modern technology as a means of communication with their borrowers.

How Much Does a Debt Collection Agency Cost?

The cost of a debt collection agency can vary greatly. Opting for an agency that has a commission structure can be a good option. In this form of arrangement, the collection agency charges a percentage of the debt recovered as a commission. This eliminates the burden of paying more to a collection agency.

Choosing a collection agency that charges the lowest fee and commits to a policy of ‘No Collection, No Fee’ is also a good option. Which means that fees will be paid only when the debt is collected.

Conclusion

In addition to reducing your stress of collecting debts, a reliable debt collection agency will also ensure complete transparency while keeping your relationships with your clients intact. A debt collection agency can help ensure a smooth process of collecting debt or invoices from clients.

Debt collection agency is mainly meant to collect money due to creditors including banks or credit card companies. They are employed to represent the original creditor to collect debtors and make an appointment about payment or a settlement. In a way, they act as a third party to meet and solve pending financial claims.

It is not advised to ignore the debt collection agency as there could be some dire consequences of the same. The agency will press on with the collection and the debt may result into a lawsuit or a court order to pay or even a wage garnishment. Above all, avoiding them will almost certainly break your credit rating and make future loans or credit hard to get.

Debthaven When your debt is passed onto a collection agency, that indicates the original creditor has made peace with the idea that they are not going to collect this debt on their own. The agency will initiate calling you to get their money paid and the bad debt will be reported as a negative credit entry on your credit record. That may severely drag down your credit rating and stay in your history as many as seven years.

Never talking to a debt collector denies you the chance to work out a payment schedule or pay less than the whole amount of the debt. The debt is probably going to stay on your credit, and the collection agency might go further to sue you to obtain a judgment. Directly dealing with the debt is one of the most advisable things to do most of the time.

It depends, but yes most debt collectors will take a payment plan, because their primary aim is to collect as much of the debt as they can. Provided that you are not able to pay it all at a time, then you must be able to provide a decent and realistic timetable of payment. Working out a plan is much more preferable, as opposed to attempting to avoid, as contact will only compound the problem.

Do Like & Share

-

New Year, Zero Dues To Recover: Business Resolution That Actually Pays Off

New Year, Zero Dues To Recover: Business Resolution That Actually Pays Off -

What Do You Do When a Client Doesn’t Pay Their Overdue Invoice?

What Do You Do When a Client Doesn’t Pay Their Overdue Invoice? -

The 31st Dec Deadline: Don't Let Your Profit Stay Unpaid

The 31st Dec Deadline: Don't Let Your Profit Stay Unpaid -

How to Choose the Right Invoice Collection Agency for Your Business

How to Choose the Right Invoice Collection Agency for Your Business -

Legal Steps to Take When an Invoice Goes Unpaid

Legal Steps to Take When an Invoice Goes Unpaid -

What Happens When You Hire an Invoice Collection Agency?

What Happens When You Hire an Invoice Collection Agency? -

The Legal Rights of Businesses in Unpaid Invoice Recovery

The Legal Rights of Businesses in Unpaid Invoice Recovery -

Credit Notes- What Are They and How Are they Useful To Receivables and Payables

Credit Notes- What Are They and How Are they Useful To Receivables and Payables